Understanding the Relevance of Insurance coverage and Why You Must Have It

Insurance coverage, commonly viewed as a grudging requirement, fundamentally offers as a crucial bulwark against monetary tragedy. It shifts the burden of risk from the private to a collective pool, managed by insurers who assess and reduce these risks skillfully. This change not only safeguards individual and company assets but additionally finances the self-confidence needed to pursue ventures with greater threat profiles. However, picking the ideal insurance policy is not uncomplicated, affected by myriad variables that need cautious consideration. This intricacy frequently brings about mistaken beliefs and underinsurance, leaving one to wonder: what are the concealed costs of poor insurance coverage?

The Role of Insurance Policy in Taking Care Of Threat

Key Kinds Of Insurance Plan and Their Advantages

Health and wellness insurance coverage, for circumstances, covers clinical costs, mitigating the financial burden of disease and a hospital stay. Life insurance policy offers financial safety to beneficiaries in the event of the insurance holder's death, making sure economic security throughout hard times.

Car insurance coverage is necessary in many regions and covers responsibilities and problems in car crashes, promoting roadway security by making it possible for vehicle drivers to cover the costs of prospective problems. Finally, obligation insurance guards people and companies from financial loss developing from lawful responsibilities, hence protecting personal or organization possessions versus claims and claims. Each sort of insurance coverage functions as a calculated tool for taking care of specific threats, making them vital in expert and personal spheres.

Just How Insurance Policy Sustains Financial Stability and Growth

Entrepreneurs and businesses are a lot more original site most likely to invest in brand-new endeavors or increase existing ones when they have insurance policy to cover potential risks. Thus, insurance policy is essential not simply for private safety and security yet additionally for the broader economic landscape.

The Process of Picking the Right Insurance Policy Coverage

Choosing the appropriate insurance policy coverage can typically appear discouraging. It is vital to begin by determining the dangers that one looks for to you could try this out reduce.

Following, contrasting various insurance coverage service providers is crucial. This includes examining their online reputation, insurance coverage terms, premium expenses, and client service records. Utilizing online contrast tools can simplify this action, giving a side-by-side sight of choices.

In addition, seeking advice from an insurance policy broker or monetary expert can provide understandings customized to certain situations. These professionals can debunk intricate conditions, helping to ensure that the chosen insurance coverage effectively fulfills the individual's or service's demands without unnecessary costs. abilene tx insurance agency. Therefore, thoughtful analysis and professional recommendations are type in picking the appropriate insurance policy

Usual Misunderstandings About Insurance Policy Debunked

While choosing the right insurance policy protection is a precise procedure, there are extensive misconceptions about insurance policy that can prevent educated decisions. One common myth is that more youthful individuals don't require insurance policy, specifically health and wellness or life insurance coverage.

There is the wrong idea that all insurance plans are essentially the very same. Comprehending these facts is essential for making knowledgeable insurance choices.

Final Thought

To conclude, insurance coverage plays a vital role in handling threat and promoting economic stability. By understanding and investing in the proper insurance coverage people, plans and businesses can safeguard themselves against potential losses, thereby allowing financial development and individual protection. Selecting the ideal insurance coverage is crucial, and disproving typical mistaken beliefs regarding insurance policy can bring about even more informed choices, ensuring that one's economic future is well-protected versus unpredicted scenarios.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Bug Hall Then & Now!

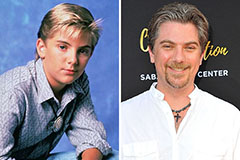

Bug Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now!